Insurtech Gateway is proud to announce that we have been named by the Financial Times and Statista as one of Europe’s Leading Startup Hubs!

In depth research and founder surveys were done on 3,000 startup hubs across Europe to carefully compile the top 125. After seven years of hard work crafting our specialist incubation service, we are thrilled to be recognised in this inaugural report.

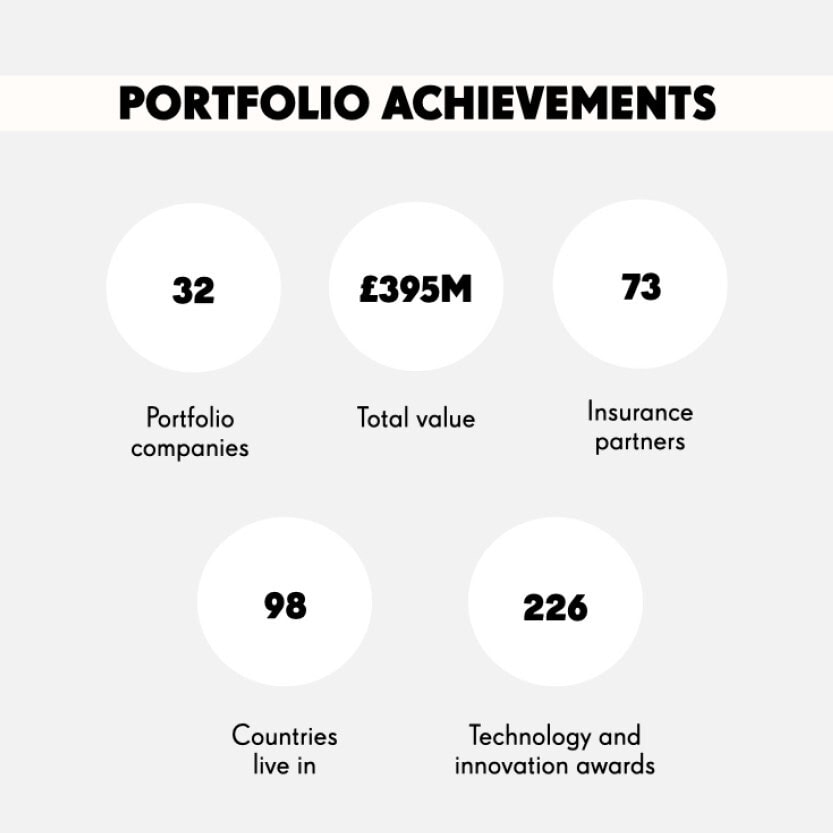

Insurtech Gateway track record

Insurtech Gateway is a specialist insurtech incubator, the fastest place to launch an insurtech idea. We have a unique ability to help founders outside insurance who are pioneering the future of insurance products.

We are the home of breakthrough technology:

- First risk model for offshore wind.

- First fully-regulated marketplace for on-chain insurance.

- First carbon credit insurance.

- First smart contract solution protecting construction from extreme weather.

- First cryptocurrency theft prevention technology.

- First catastrophic flood claim paid in full in under 6 hours.

- First to insure milk yield.

Insurtech Gateway Capability

We have the only ready-built capability to turn raw ideas into new insurance product

lines. We have a proven formula to build innovative products, something that has proven

impossible in large corporates.

Insurtech Gateway Incubators invest in one company at a time to guarantee hands-on guidance for every founder. By tailoring a unique programme for each entrepreneur, the Gateway team de-risks early-stage businesses and gets them to market in record time.

PRODUCT MARKET FIT

We offer founders expert guidance on the product, target market, distribution and scale-up model. We also facilitate access to build partners across tech and insurance.

“The idea for Coincover had been floating around for some time, but as I knew nothing about insurance at the time it wasn’t really going anywhere. Insurtech Gateway invited me to meet the team and we talked through a whole bunch of unstructured thoughts. Four weeks later, the Gateway team had helped us shape the idea and we were pitching it to a room full of insurance experts and after we got the answer of ‘ Well… it’s not bonkers.’ we haven’t looked back.”

David Janczewski, Co-Founder of Coincover

INSURANCE PLATFORM

- Insurance Product and Capacity

- Expert guidance on the insurance product structure

- Plug into UK (re-)insurance capacity for launch.

- Plug into global (re-)insurance capacity for scale-up.

- Pilot propositions with leading insurers.

- FCA Authorisation

- Guided process to become an FCA regulated business

- Become an Appointed Representative of the Gateway in a matter of weeks.

- Transition to full FCA authorisation without any interruption to ongoing trading.

- Insurance Metrics

- Defining critical insurance metrics and milestones for launch and scale-up.

- Driving understanding of the key insurance metrics across all stakeholders.

“Without the support of Insurtech Gateway, there might not have been a Bondaval. By sponsoring us as an Appointed Representative under their FCA license, Insurtech Gateway gave us the regulatory support we needed to start operating immediately: the equivalent of a two-year head start. Now, their guidance has helped us to navigate the process and become directly authorised with the FCA ourselves. They have been invaluable champions of the business, and their continued support is greatly appreciated.”

Tom Powell, CEO of Bondaval

INVESTMENT

We invest early as we can add most value at Pre-Seed. If you already have a defined product and pilots running we can invest at Seed. As you grow our dedicated Gateway Funds follow on with investment up to Series A and we pull in our global venture capital network of later stage investors.

We support all our founders with defining critical investor metrics for launch and scale-up.

“Insurtech Gateway’s deep industry expertise, insurance network and track record of securing the relevant FCA authorisations for early-stage insurtech businesses clearly differentiates them from other seed stage funds. During our fundraising journey Insurtech Gateway provided us with ample support, progressed quickly and made introductions to impactful angels and excellent co-investors.”

Karan Mehta, Co-Founder and CEO at Bluezone

The Team

Our team have deep insurance expertise and extensive venture design and launch experience. They are hands on and here to help.

‘The Gateway’s founder-friendly approach to funding helped us to navigate through something totally new to us. It felt like we’d found a real ally, thanks to the truly cooperative process, and the invaluable expertise provided by the Gateway team. Even through due diligence and legal we felt supported, rather than as if we were trying to be caught out. It was exactly what we needed to find our way through the insurance space and develop the product.’

Maria Mateo Iborra, Co-Founder of IBISA

Join us?

We are looking for a strategic partner who wants to own the next wave of innovation and insurance product lines and have access to £3bn of cumulative GWP. For an open conversation please get in touch.