Guest blog from Ashima Gupta, CEO at Renew Risk

In today’s world, the transition to renewable energy isn’t just an environmental imperative; it’s deeply tied to our economic future. As the demand for clean energy sources continues to soar, there’s an equally pressing need for innovative financial and insurance solutions to underpin new renewable energy projects.

With nearly 15 years of experience in the financial services sector, specialising in risk models, I understand the vital role robust risk models play in enabling financiers and risk carriers to accurately assess and navigate risks. When I realised that this understanding could drive positive change in the world – by accelerating the transition to green energy – I knew this was the path I had to follow.

THE URGENT CHALLENGE

The science is clear: to mitigate the most severe consequences of climate change, we need to cut emissions in half by 2030 and reach net-zero by 2050. We must stop using fossil fuels and switch to clean, affordable and sustainable energy sources.

“It’s time to stop burning our planet, and start investing in the abundant renewable energy all around us.”

António Guterres, United Nations Secretary-General

Fossil fuels still account for more than 80 percent of global energy production, but cleaner sources of energy are gaining ground. About 29 percent of electricity currently comes from renewable sources.* Some of the most common sources of renewable energy include wind, hydro and ocean. But building this necessary infrastructure is being delayed, as financiers and insurers don’t have the solutions to accurately assess the risks. Renew Risk was born when my co-founders and I decided to solve this problem with data-science driven products.

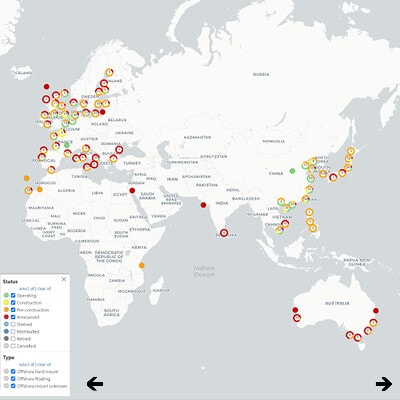

We started with offshore wind farms as this sector is experiencing explosive growth, projected to become a $1 trillion industry by 2040. A substantial portion of these billion-dollar assets will be located in deeper waters, up to 100 kilometres offshore, and in regions prone to natural disasters like earthquakes and hurricanes. Financiers and insurers must effectively assess these risks before supporting a project, but current solutions are inadequate. Renew Risk’s robust risk assessment solutions are indispensable for financiers and insurers for regulatory risk capital and control.

OUR APPROACH

From the beginning the vision was to craft robust products for financiers and insurers, reshaping the global approach to managing renewable energy risks, all in pursuit of unleashing the full potential of green energy.

To bring this vision to life, assembling a dynamic team with diverse expertise spanning data science, renewable energy, banking, and insurance was imperative. Fortuitously, the envisioned founding team consisted of individuals who had developed personal relationships over the past five years, rapidly forming a closely-knit team of four co-founders

In June 2021, the four of us came together to deliberate on the intricacies of turning our idea into reality. Countless discussions ensued, where we dissected what we could build, how to build it, and our unwavering motivation to build it, and carefully weighed the advantages and disadvantages. After careful consideration, we collectively took the plunge and officially incorporated Renew Risk in November 2021.

OUR MOTIVATION

We have been going strong since then, growing the business with new clients and expanding the team to 10 with a strong bank of advisors. We used our expertise to develop innovative industry-steered risk solutions and have already started contributing to a greener, more sustainable economy. Renew Risk embarked on this journey to create cutting-edge risk solutions from the ground up, employing a best-in-class engineering and data science approach. Our innovative software – the world’s first of its kind – calculates the frequency and severity of financial losses stemming from natural disasters. This technology is vital for (re)insurers and offshore wind farm developers.

Today, Renew Risk is approaching its second anniversary. Our journey thus far has been a blend of exhilaration and challenge. It’s been exhilarating due to the overwhelmingly positive market feedback and early successes with three insurance clients. However, it’s also been an arduous journey, with the demanding task of fundraising during one of the most challenging economic periods.

Fortunately, Insurtech Gateway recognised our vision and embraced it wholeheartedly. We are overjoyed to welcome them aboard and eagerly anticipate accelerating our business with their team’s sector expertise and expansive network.

A note from Insurtech Gateway

“Thank you so much for sharing your story Ashima, we are proud to be supporting a venture with so much potential to make an impact at scale. At Insurtech Gateway we are always eager to meet founders with deep domain expertise – like Ashima and the Renew Risk team. When experts in data science and renewable energy team up with experts in banking and insurance they have the skills to fundamentally change how we assess risk. If you have a big idea or have already founded a pre-seed or seed insurtech, we have the experience and the tools to help you launch and scale faster. Check out our incubator and venture fund or get in touch.”

References: United Nations