The line between personal and professional life is becoming increasingly blurred. Caregiving responsibilities, whether for ageing parents, children, or loved ones with disabilities, are a universal reality for a significant portion of the workforce. This reality often leads to increased stress, burnout, absence, and a reduction in work productivity. Recognising this challenge, Insurtech Gateway are delighted to co-lead the £1.4m Seed Funding in Yurtle with Mustard Seed Maze.

WHAT DOES YURTLE DO?

Yurtle is building an employer paid employee benefit to alleviate caregiver burnout in the workplace. Their product blends an insurance promise to pay for continuity of care in the event of illness or accident, as well as a care management platform to deliver high quality care without compromising health. Employees can access replacement, domiciliary caregivers within hours, as well as a family planning platform with educational resources and the means to coordinate a resilient care team.

Continuously expanding their carer’s offering, two newer products the team are excited to share include a Carer’s Workplace Policy product, and a supportive digital ally ‘Yurtly’, with both already receiving praise from the market.

WHAT GOT US EXCITED?

Focused solution capitalising market tailwinds:

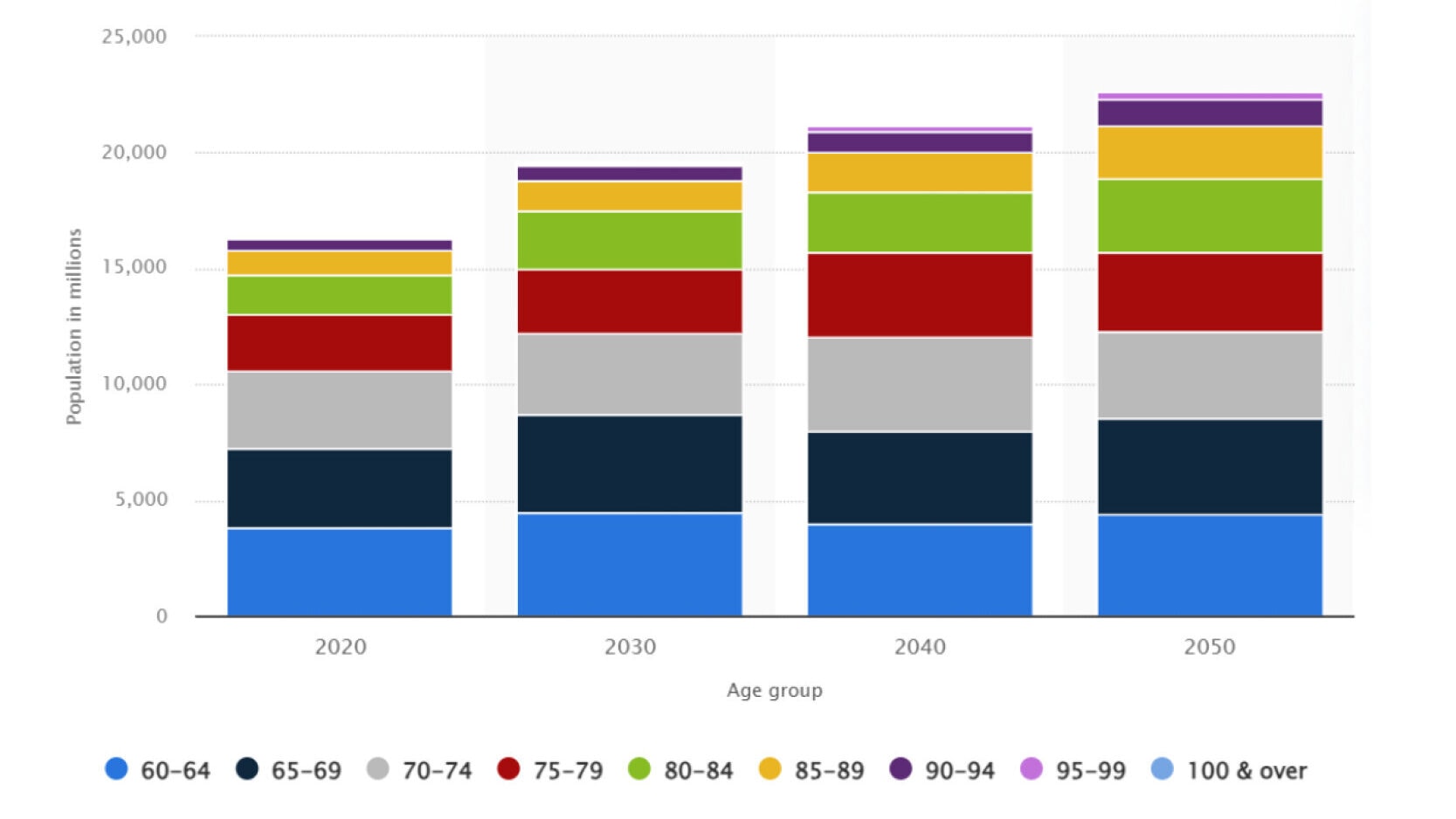

The UK population is ageing at an unprecedented rate. By 2030, the number of people aged 60 or over is expected to have increased by ~30%. An approximate 600 employees a day leave work to care, and inadequate support for working carers costs UK businesses £8.2bn every year. Between 2010 and 2020, more than 1.9 million people in paid employment became unpaid carers every year (Petrillo and Bennett, 2022), and this is expected to increase. With similar trajectories at a global scale, 1 in 6 people will be aged 60 years or over by 2030, 1.4 billion people.

Well-defined, scalable distribution routes:

Strategy focuses on direct routes via Employee Benefit Consultants combined with a bolt-on approach with Group Risk Providers. This has led to serving >2000 employees to date, with a new 850-person company secured earlier this month. With access to 65% of the UK corporate market via partnerships with intermediaries, Yurtle is primely positioned to continue executing on customer pipeline.

Team, team, team:

Antonio is one of the most genuine and ambitious founders I’ve been fortunate enough to get to know, with an innate ability to build interpersonal relationships – a testament to the pain-point he’s addressing, and the high calibre team he has built around him. Equipped with experience in Insurance (most recently as a Client Relationship Manager at Legal and General), political and trade credit risk, with time in underwriting, claims and regulatory roles – suffice to say he has a strong handle of the industry. We’re delighted to see the senior leadership strengthened with:

- Aaron Dryden – Carer Experience Lead, with over two decades building propositions in social care

- Joseph Cook – Operations Manager, ex-First Minute Capital

- Paul Nichols – CTO, ex-founder with 10+ years in software development, CompSci degree from Oxford

- Hollie Nairn – Head of Sales, 10+ years in BD and Sales Consultancy at large insurers and EB provider, Unum

SUMMARY

Whilst the US market is beginning to wake up – with startups like Wellthy, Family First and Helpful raising $25m, $11m, $8m respectively in 2023 – caring for caregivers is largely an overlooked customer segment. The new Carers’ Leave Act which the UK Government will be implementing from the 6th April (entitling employees to take one week of leave to care for a dependant every year) will hopefully turn up the volume, however, solutions like Yurtle will need to exist. Insurtech Gateway and Yurtle are placing a high conviction bet on ‘ageing-in-place’, that the majority of people often want to age and die at home, cared for by their loved ones. We’re delighted to welcome Yurtle to the portfolio, keep your eyes carefully peeled for more news to come.

GET IN TOUCH

If you have founded a Pre-Seed or Seed insurtech and are looking for support and funding – or maybe you just have an idea that you would like to chat through – we have the experience and toolkit to help you get to market faster. Check out our incubator and venture fund.