Insurtech Gateway are delighted to lead the £1.7m Seed funding round in Renew Risk, with participation from One Planet Capital and global strategic angels.

In a world where environmental concerns are no longer just a topic of discussion but a pressing global priority, the transition to renewable energy adoption needs technology to play an important role. Through an equally fun, educational, and intense due diligence process with the Renew Risk team, we learnt that one of the most promising sectors within renewables is offshore wind farms.

What does Renew Risk do?

In a nutshell, they’re building a B2B risk modelling and analytics SaaS. Their solution enables (re)insurers, insurance brokers and developers to accurately and robustly assess the risks associated with constructing offshore wind farms and other large renewable energy assets. Other catastrophe risk vendors are struggling to cater for offshore wind, rely on status-quo legacy systems, and are often an extrapolation of onshore models. Renew Risk models standout as being built with proprietary offshore datasets, addressing the specific climate perils to each location.

Global Market Opportunity

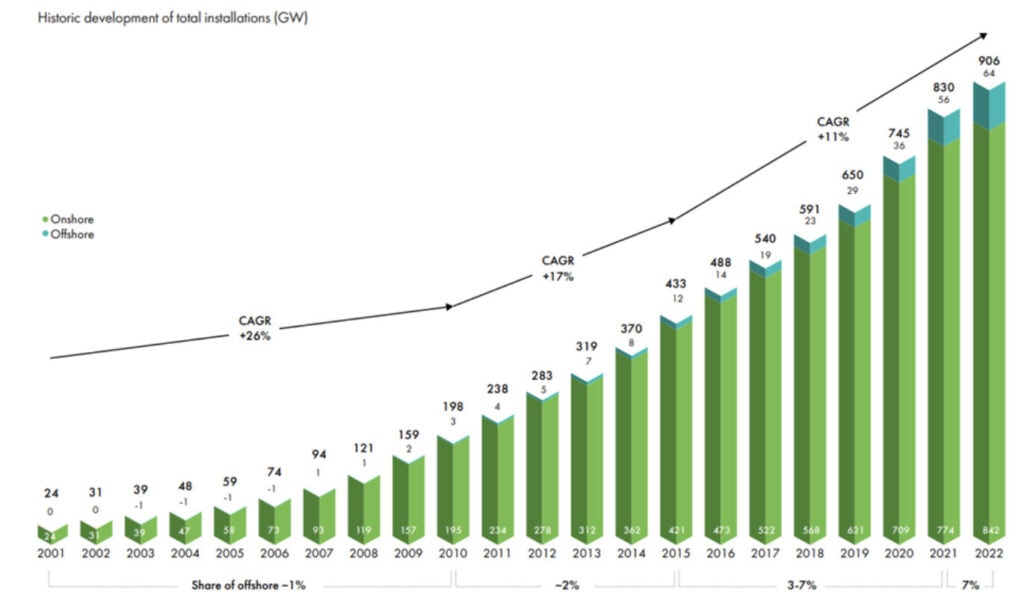

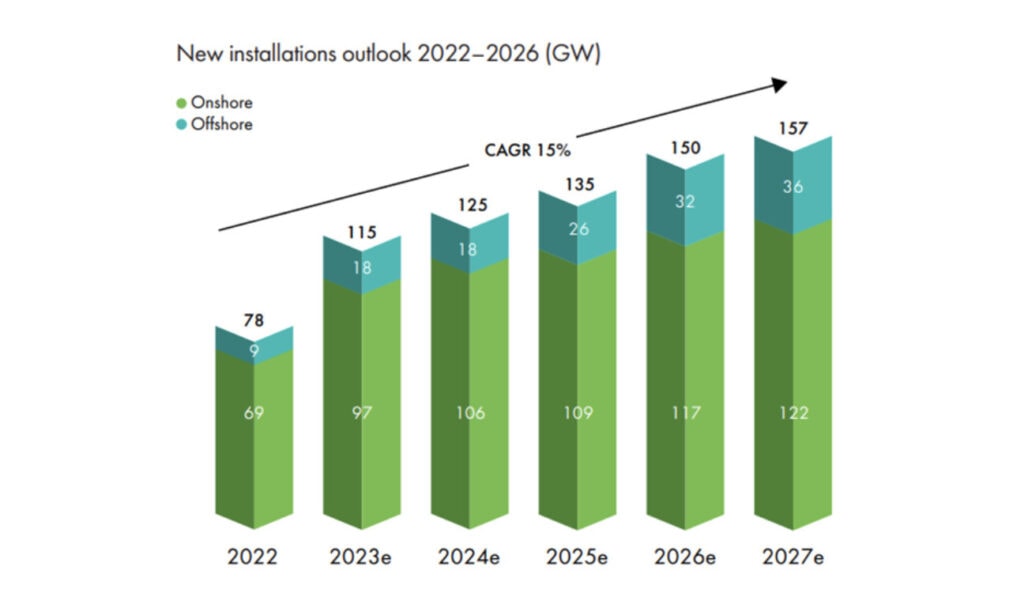

After my first call with Ashima, Joshua and the team, I soon learnt that what might have initially seemed like a small drop in the ocean (pun intended) was in fact a multi-trillion – and growing – market opportunity. The historic development of wind farm installations shows meteoric onshore growth, but scarcity of land has recently led to the utilisation of offshore, deep-sea potential. As of today, there are over 150 offshore wind farms operating around the world, representing 7% of global capacity. A total of 680 Gigawatts (GW) of new wind capacity will be installed globally by 2027, of which 130 GW will be offshore*. To contextualise energy potential, Hornsea 2* – the world’s largest offshore wind farm situated off the coast of Yorkshire, England – has a capacity of more than 1.3 GW and is set to power in excess of 1.4 million UK homes.

The overall increase in renewable wind energy to date combined with the proportional, significant increase in offshore wind specifically sets a compelling backdrop to the Renew Risk proposition.

But what is their edge?

Wearing my investor hat, as with all early-stage pre-seed / seed investment opportunities, we over-index on team, team and team. Luckily for us, long-time friends Ashima, Josh, Suby and Gaurav came to us with impressive experience spanning across Data Science, Civil Engineering, and Risk Modelling, with educational roots from UCL, Cambridge and Oxford University. They came equipped with previous roles at Lloyds Banking Group, World Bank and other entrepreneurial ventures, as well as established networks in Lloyds of London Insurance. We were certainly ‘wowed’ and convinced they had an advantage. In fact, nothing screams ‘deep domain expertise’ louder than when Suby (PhD in Civil Engineering from Cambridge) brought his own book ‘Design of Foundations for Offshore Wind Turbines’ to our Investment Committee. Love it.

Confidence in product and roadmap was clear from the outset, and their collective passion, drive, and genuine commitment to fostering a greener economy was extraordinary. It came as no surprise that they already had excellent relationships with their customers and partners.

Now and Beyond

Often a question with deep tech, science focused teams is whether product can achieve commercial viability. We’re delighted to say that Renew Risk has already executed on what many would take years to achieve – and there is more good news in the PR pipeline, so watch this space.

- Patented, SaaS solutions to gain comprehensive insights into risk.

- Five models in US, Taiwan and Japan covering Earthquake and Tropical Cyclone / Hurricane risk.

- Partnerships with OASIS and NASDAQ, with grant money support from Offshore Wind Growth Partnership.

- Three multi-year contracts signed with clients in the (re)insurance industry, with two executed post-close.

- Impressive pipeline of opportunities – customers and product – and a growing list of (re)insurers, developers and financiers as potential customers.

With offshore wind farm modelling as a distinct and in-demand ‘wedge’ into the Insurance Industry, the team are already thinking about long-term vision. Pioneering services in offshore wind, Renew Risk intend to move into adjacent verticals such as onshore wind and hydrogen. The operational lifecycle and financial planning of offshore wind are other markets which Renew Risk plans to capture, catering to developers and asset managers looking to optimise credit analysis.

It’s been awesome getting to know the team over the process, and we’re convinced this is only the beginning.

Get In Touch

If you have founded a Pre-Seed / Seed Insurtech and are looking for support and funding – or maybe you just have an idea that you would like to chat through – we have the experience and toolkit to help you get to market faster. Check out our incubator and venture fund.

*References: GWEC 2023 report | CNBC 2022 Hornsea 2 Report