Insurtech Gateway complete the first close on Seed Fund II.

The insurtech funding gap just got smaller

Insurtech Gateway announces the first close of Seed Fund II. This fund will enable them to support another 20 teams over the next 4 years from pre-seed to Series A.

The Gateway are on a mission to close the funding gap in early stage insurtech, and to attract a new kind of founder tackling complex climate and social challenges.

The Gateway incubates early stage founders to de-risk their regulatory and insurance metrics.

Founded in 2016, the Gateway has authorised incubators in London and Sydney, supporting 24 portfolio companies, live in 37 countries, working with 26 insurers.

The Gateway was the birthplace of many of Europe’s hottest insurtechs; By Miles, Humn, Coincover, Nayms, Loadsure, Bondaval, Collective Benefits and Floodflash.

Fund investors have opportunities for collaboration, with access to investment, underwriting and radical new partnership models.

The funding gap

Javier Santiso, CEO & General Partner, Mundi Ventures said:

“The funding environment has cooled off from the 2021 euphoria, but the industry still offers huge opportunities and is waiting for much disruption. We have seen a strong correction in public market valuations and some degree of pullback also in the private market. But in the long term, insurance is still a huge market with very low investment compared to fintech and health. It is great to see Insurtech Gateway launching a new fund to help close the insurtech funding gap.”

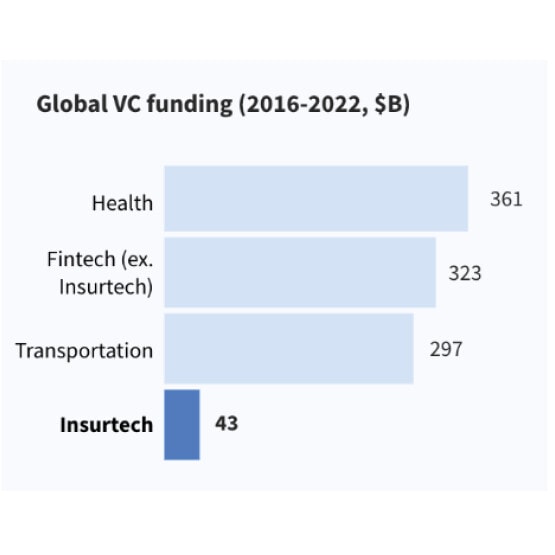

Statistics provided by Dealroom show insurtech startups are woefully underfunded compared to other verticals targeting similar market size like fintech, health and mobility.

From 2016 to 2022; health received $361bn in global VC funding, fintech (excluding insurtech) got $323bn and transportation got $297bn. Comparing this to the meagre $43bn received by insurtech throws this gap into sharp relief.

Attracting the next generation of founder

Complex social and environmental problems need a holistic approach involving many stakeholders from technology, insurance and deep domain expertise. The Gateway has created a collaborative environment where insurance principles in risk reduction, mitigation and transfer can be combined with new technology and system design to create complete solutions to new and growing protection gaps in business, climate and health.

Richard Chattock, CEO at Insurtech Gateway said:

“We believe that insurance and technology can transform society. We are proud to have created a place where independent founders can build sustainable partnerships with progressive insurers, regulators and co-investors.”

The opportunity space

Rapidly expanding and fragmented digital marketplaces have created large protection voids that threaten their sustainability and wider adoption. The Gateway are supporting founders to build bespoke, agile solutions and are connecting them to the risk market to become new sub-category leaders.

Benjamin Hay, Co-Founder at Collective Benefits said,

“The support of Insurtech Gateway has been absolutely critical to our journey – from the conceptualisation right through to the execution of our products – and we are excited to see what the future holds for our partnership!”

Gateway investor view

Fund investors benefit from high investment returns and insight into potential new lines of business. They also have opportunities for collaboration, with access to investment and underwriting deal-flow from the Incubators. In return, successful startup founders will have access to underwriting guidance and scaling support.

Jonathan (J.J.) Anderson, SVP, Global Head of Strategic Investments at RenaissanceRe said:

“The Gateway’s differentiated approach helps them identify and incubate an attractive portfolio of insurtech investments while also facilitating valuable knowledge-share and commercial collaboration with investors that support the fund.”